World Economic Outlook

World Economic Outlook, July 2019

July 2019

Still Sluggish Global Growth

- Global growth remains subdued. Since the April World Economic Outlook (WEO) report, the United States further increased tariffs on certain Chinese imports and China retaliated by raising tariffs on a subset of US imports. Additional escalation was averted following the June G20 summit. Global technology supply chains were threatened by the prospect of US sanctions, Brexit-related uncertainty continued, and rising geopolitical tensions roiled energy prices.

- Against this backdrop, global growth is forecast at 3.2 percent in 2019, picking up to 3.5 percent in 2020 (0.1 percentage point lower than in the April WEO projections for both years). GDP releases so far this year, together with generally softening inflation, point to weaker-than-anticipated global activity. Investment and demand for consumer durables have been subdued across advanced and emerging market economies as firms and households continue to hold back on long-range spending. Accordingly, global trade, which is intensive in machinery and consumer durables, remains sluggish. The projected growth pickup in 2020 is precarious, presuming stabilization in currently stressed emerging market and developing economies and progress toward resolving trade policy differences.

- Risks to the forecast are mainly to the downside. They include further trade and technology tensions that dent sentiment and slow investment; a protracted increase in risk aversion that exposes the financial vulnerabilities continuing to accumulate after years of low interest rates; and mounting disinflationary pressures that increase debt service difficulties, constrain monetary policy space to counter downturns, and make adverse shocks more persistent than normal.

- Multilateral and national policy actions are vital to place global growth on a stronger footing. The pressing needs include reducing trade and technology tensions and expeditiously resolving uncertainty around trade agreements (including between the United Kingdom and the European Union and the free trade area encompassing Canada, Mexico, and the United States). Specifically, countries should not use tariffs to target bilateral trade balances or as a substitute for dialogue to pressure others for reforms. With subdued final demand and muted inflation, accommodative monetary policy is appropriate in advanced economies, and in emerging market and developing economies where expectations are anchored. Fiscal policy should balance multiple objectives: smoothing demand as needed, protecting the vulnerable, bolstering growth potential with spending that supports structural reforms, and ensuring sustainable public finances over the medium term. If growth weakens relative to the baseline, macroeconomic policies will need to turn more accommodative, depending on country circumstances. Priorities across all economies are to enhance inclusion, strengthen resilience, and address constraints on potential output growth.

Subdued Momentum

Weak final demand

Against a difficult backdrop that included intensified US-China trade and technology tensions as well as prolonged uncertainty on Brexit, momentum in global activity remained soft in the first half of 2019. There were positive surprises to growth in advanced economies, but weaker-than-expected activity in emerging market and developing economies.

Growth was better than expected in the United States and Japan, and one-off factors that had hurt growth in the euro area in 2018 (notably, adjustments to new auto emissions standards) appeared to fade as anticipated.

Among emerging market and developing economies, first quarter GDP in China was stronger than forecast, but indicators for the second quarter suggest a weakening of activity. Elsewhere in emerging Asia, as well as in Latin America, activity has disappointed.

Despite the upside surprises in headline GDP for some countries, data more broadly paint a picture of subdued global final demand, notably in fixed investment. Inventory accumulation of unsold goods lifted first quarter GDP in the United States and the United Kingdom, while soft imports boosted output in China and Japan.

From a sectoral perspective, service sector activity has held up, but the slowdown in global manufacturing activity, which began in early 2018, has continued, reflecting weak business spending (machinery and equipment) and consumer purchases of durable goods, such as cars. These developments suggest that firms and households continue to hold back on long-range spending amid elevated policy uncertainty.

Soft global trade

Spending patterns are also reflected in global trade, which tends to be intensive in investment goods and consumer durables. Trade volume growth declined to around ½ percent year-on-year in the first quarter of 2019 after dropping below 2 percent in the fourth quarter of 2018. The slowdown was particularly notable in emerging Asia.

Weak trade prospects—to an extent reflecting trade tensions—in turn create headwinds for investment. Business sentiment and surveys of purchasing managers for example point to a weak outlook for manufacturing and trade, with particularly pessimistic views on new orders. The silver lining remains the performance of the service sector, where sentiment has been relatively resilient, supporting employment growth (which, in turn, has helped shore up consumer confidence).

Muted inflation

Consistent with subdued growth in final demand, core inflation across advanced economies has softened below target (for example in the United States) or remained well below it (euro area, Japan). Core inflation has also dropped further below historical averages in many emerging market and developing economies, barring a few cases such as Argentina, Turkey, and Venezuela.

With global activity generally remaining subdued, supply influences continued to dominate commodity price movements, notably in the case of oil prices (affected by civil strife in Venezuela and Libya and US sanctions on Iran). Despite the large run-up in oil prices through April (and higher import tariffs in some countries), cost pressures have been muted, reflecting still-tepid wage growth in many economies even as labor markets continued to tighten. Headline inflation has therefore remained subdued across most advanced and emerging market economies. These developments have contributed, in part, to market pricing of expected inflation dropping sharply in the United States and the euro area.

Mixed policy cues and shifts in risk appetite

Policy actions and missteps have played an important role in shaping these outcomes, not least through their impact on market sentiment and business confidence. While the six-month extension to Brexit announced in early April provided some initial reprieve, escalating trade tensions in May, fears of disruptions to technology supply chains, and geopolitical tensions (for example, US sanctions on Iran) undermined market confidence (Box 1).

Risk sentiment appears to have regained some ground in June, supported by central bank communications signaling the likelihood of further accommodation. Following the June G20 summit, where the United States and China agreed to resume trade talks and avoided further increases in tariffs, market sentiment has been lifted by the prospect of the two sides continuing to make progress toward resolving their differences. Financial conditions in the United States and the euro area are now easier than at the time of the April WEO, while remaining broadly unchanged for other regions.

Global Growth Still Sluggish

Global growth is projected at 3.2 percent for 2019, improving to 3.5 percent in 2020 (0.1 percentage point lower for both years than in the April 2019 WEO forecast). On the trade front, the forecast reflects the May 2019 increase of US tariffs on $200 billion of Chinese exports from 10 percent to 25 percent, and retaliation by China. The downgrades to the growth forecast for China and emerging Asia are broadly consistent with the simulated impact of intensifying trade tensions and associated confidence effects discussed in Scenario Box 1 of the October 2018 WEO.

The projected pickup in global growth in 2020 relies importantly on several factors: (1) financial market sentiment staying generally supportive; (2) continued fading of temporary drags, notably in the euro area; (3) stabilization in some stressed emerging market economies, such as Argentina and Turkey; and (4) avoiding even sharper collapses in others, such as Iran and Venezuela. About 70 percent of the increase in the global growth forecast for 2020 relative to 2019 is accounted for by projected stabilization or recovery in stressed economies. In turn, these factors rely on a conducive global policy backdrop that ensures the dovish tilt of central banks and the buildup of policy stimulus in China are not blunted by escalating trade tensions or a disorderly Brexit.

For advanced economies, growth is projected at 1.9 percent in 2019 and 1.7 percent in 2020. The 2019 projection is 0.1 percentage point higher than in April, mostly reflecting an upward revision for the United States.

- In the United States, 2019 growth is expected to be 2.6 percent (0.3 percentage point higher than in the April WEO), moderating to 1.9 percent in 2020 as the fiscal stimulus unwinds. The revision to 2019 growth reflects stronger-than-anticipated first quarter performance. While the headline number was strong on the back of robust exports and inventory accumulation, domestic demand was somewhat softer than expected and imports weaker as well, in part reflecting the effect of tariffs. These developments point to slowing momentum over the rest of the year.

- Growth in the euro area is projected at 1.3 percent in 2019 and 1.6 percent in 2020 (0.1 percentage point higher than in April). The forecast for 2019 is revised down slightly for Germany (due to weaker-than-expected external demand, which also weighs on investment), but it is unchanged for France (where fiscal measures are expected to support growth and the negative effects of street protests are dissipating) and Italy (where the uncertain fiscal outlook is similar to April’s, taking a toll on investment and domestic demand). Growth has been revised up for 2019 in Spain, reflecting strong investment and weak imports at the start of the year. Euro area growth is expected to pick up over the remainder of this year and into 2020, as external demand is projected to recover and temporary factors (including the dip in German car registrations and French street protests) continue to fade.

- The United Kingdom is set to expand at 1.3 percent in 2019 and 1.4 percent in 2020 (0.1 percentage point higher in 2019 than forecast in the April WEO). The upward revision reflects a stronger-than-anticipated first quarter outturn boosted by pre-Brexit inventory accumulation and stockpiling. This is likely to be partially offset by payback over the remainder of the year. Monthly GDP for April recorded a sharp contraction, in part driven by major car manufacturers bringing forward regular annual shutdowns as part of Brexit contingency plans. The forecast assumes an orderly Brexit followed by a gradual transition to the new regime. However, as of mid-July, the ultimate form of Brexit remained highly uncertain.

- Japan’s economy is set to grow by 0.9 percent in 2019 (0.1 percentage point lower than anticipated in the April WEO). The strong first quarter GDP release reflects inventory accumulation and a large contribution from net exports due to the sharp fall in imports, thus masking subdued underlying momentum. Growth is projected to decline to 0.4 percent in 2020, with fiscal measures expected to somewhat mitigate the volatility in growth from the forthcoming October 2019 increase in the consumption tax rate.

The emerging market and developing economy group is expected to grow at 4.1 percent in 2019, rising to 4.7 percent in 2020. The forecasts for 2019 and 2020 are 0.3 and 0.1 percentage point lower, respectively, than in April, reflecting downward revisions in all major regions.

- Emerging and developing Asia is expected to grow at 6.2 percent in 2019–20. The forecast is 0.1 percentage point lower than in the April WEO for both years, largely reflecting the impact of tariffs on trade and investment. In China, the negative effects of escalating tariffs and weakening external demand have added pressure to an economy already in the midst of a structural slowdown and needed regulatory strengthening to rein in high dependence on debt. With policy stimulus expected to support activity in the face of the adverse external shock, growth is forecast at 6.2 percent in 2019 and 6.0 percent in 2020—0.1 percentage point lower each year relative to the April WEO projection. India’s economy is set to grow at 7.0 percent in 2019, picking up to 7.2 percent in 2020. The downward revision of 0.3 percentage point for both years reflects a weaker-than-expected outlook for domestic demand.

- The subdued outlook for emerging and developing Europe in 2019 largely reflects prospects for Turkey, where—after a growth surprise in the first quarter from stronger-than-expected fiscal support—the contraction in activity associated with needed policy adjustments is projected to resume. Several other countries in central and eastern Europe are experiencing strong growth on the back of resilient domestic demand and rising wages. The region is expected to grow at 1 percent in 2019 (0.2 percentage point higher than in the April WEO, buoyed by robust first quarter growth). Growth is expected to improve to 2.3 percent in 2020 (0.5 percentage point lower than in the April WEO, largely reflecting the projected growth slowdown for the remainder of 2019 in Turkey).

- In LatinAmerica, activity slowed notably at the start of the year across several economies, mostly reflecting idiosyncratic developments. The region is now expected to grow at 0.6 percent this year (0.8 percentage point lower than in the April WEO), recovering to 2.3 percent in 2020. The sizable downward revision for 2019 reflects downgrades to Brazil (where sentiment has weakened considerably as uncertainty persists about the approval of pension and other structural reforms) and Mexico (where investment remains weak and private consumption has slowed, reflecting policy uncertainty, weakening confidence, and rising borrowing costs, which could climb further following the recent sovereign rating downgrade). Argentina’s economy contracted in the first quarter of the year, although at a slower pace than in 2018. The growth forecast for 2019 is revised down slightly compared with the April WEO, and the recovery in 2020 is now projected to be more modest. Chile’s growth projection is revised down slightly, following weaker-than-expected performance at the start of the year, but is expected to pick up in 2020 helped by more accommodative policies. The deep humanitarian crisis and economic implosion in Venezuela continue to have a devastating impact, with the economy expected to shrink about 35 percent in 2019.

- Growth in the Middle East, North Africa, Afghanistan, and Pakistan region is expected to be 1.0 percent in 2019, rising to about 3.0 percent in 2020. The forecast for 2019 is 0.5 percentage point lower than in the April WEO, largely due to the downward revision to the forecast for Iran (owing to the crippling effect of tighter US sanctions). Civil strife across other economies, including Syria and Yemen, add to the difficult outlook for the region. Partially offsetting these developments are improved prospects for Saudi Arabia’s economy—the non-oil sector is expected to strengthen in 2019 with higher government spending and improved confidence, and in 2020 with an increase in oil sector growth.

- In sub-Saharan Africa, growth is expected at 3.4 percent in 2019 and 3.6 percent in 2020, 0.1 percentage point lower for both years than in the April WEO, as strong growth in many non-resource-intensive countries partially offsets the lackluster performance of the region’s largest economies. Higher, albeit volatile, oil prices have supported the outlook for Angola, Nigeria, and other oil-exporting countries in the region. But growth in South Africa is expected at a more subdued pace in 2019 than projected in the April WEO following a very weak first quarter, reflecting a larger-than-anticipated impact of strike activity and energy supply issues in mining and weak agricultural production.

- Activity in the Commonwealth of Independent States is projected to grow at 1.9 percent in 2019, picking up to 2.4 percent in 2020. The 0.3 percentage point downward revision to 2019 growth reflects a downgrade to Russia’s outlook following a weak first quarter.

Downside Risks Dominate

Downside risks have intensified since the April 2019 WEO. They include escalating trade and technology tensions, the possibility of a protracted risk-off episode that exposes financial vulnerabilities accumulated over years of low interest rates, geopolitical tensions, and mounting disinflationary pressures that make adverse shocks more persistent.

Disruptions to trade and tech supply chains: Business confidence and financial market sentiment have been repeatedly buffeted since early 2018 by a still-unfolding sequence of US tariff actions, retaliation by trading partners, and prolonged uncertainty surrounding the United Kingdom’s withdrawal from the European Union. In May, the breadth of the tensions widened to include the prospect of US actions relating to Chinese technology companies and the US threat to levy tariffs on Mexico in the absence of measures to curb cross-border migration. While the tensions abated in June, durable agreements to resolve differences remain subject to possibly protracted and difficult negotiations. The principal risk factor to the global economy is that adverse developments—including further US-China tariffs, US auto tariffs, or a no-deal Brexit—sap confidence, weaken investment, dislocate global supply chains, and severely slow global growth below the baseline.

Abrupt shifts in risk sentiment: As discussed earlier, the increase in US-China trade tensions in May caused a rapid deterioration in global risk appetite. While sentiment improved in June, potential triggers for other such risk-off episodes abound, including further increases in trade tensions; protracted fiscal policy uncertainty and worsening debt dynamics in some high-debt countries; an intensification of the stress in large emerging markets currently in the midst of difficult macroeconomic adjustment processes (such as in Argentina and Turkey); or a sharper-than-expected slowdown in China, which is dealing with multiple growth pressures from trade tensions and needed domestic regulatory strengthening. A risk-off episode, depending on its severity, could expose financial vulnerabilities accumulated during years of low interest rates as highly leveraged borrowers find it difficult to roll over their debt and as capital flows retrench from emerging market and frontier economies.

Disinflationary pressures: Concerns about disinflationary spirals eased during the period of the cyclical upswing of mid-2016 to mid-2018. Slower global growth and the drop in core inflation across advanced and emerging market economies have revived this risk. Lower inflation and entrenched lower inflation expectations increase debt service difficulties for borrowers, weigh on corporate investment spending, and constrain the monetary policy space central banks have to counter downturns, meaning that growth could be persistently lower for any given adverse shock.

Climate change, political risks, conflict: Climate change remains an overarching threat to health and livelihoods in many countries, as well as to global economic activity. Domestic policy mitigation strategies are failing to muster wide societal support in some countries. Meanwhile, international cooperation is diluted by the non-participation of key countries. Other risks previously discussed in the April WEO have become even more salient in recent months, notably rising geopolitical tensions in the Persian Gulf. At the same time, civil strife in many countries raises the risks of horrific humanitarian costs, migration strains in neighboring countries, and, together with geopolitical tensions, higher volatility in commodity markets.

Policy Priorities

Considering that the projected pickup in global growth remains precarious and subject to downside risks, appropriately calibrated macroeconomic policies are central to stabilizing activity and strengthening the foundations of the recovery. As a corollary, policy missteps and associated uncertainty will have a severely debilitating effect on sentiment, growth, and job creation.

At the multilateral level, the pressing needs are, first, to reduce trade and technology tensions and, second, to expeditiously resolve uncertainty around changes to long-standing trade agreements (including those between the United Kingdom and the European Union as well as between Canada, Mexico, and the United States). Specifically, countries should not use tariffs to target bilateral trade balances. More fundamentally, trade disputes may be symptoms of deeper frustration with gaps in the rules-based multilateral trading system. Policymakers should cooperatively address these gaps and strengthen the rules-based multilateral trading system, including by ensuring continued enforcement of existing World Trade Organization (WTO) rules through a well-functioning WTO dispute settlement system; resolving the deadlock over its appellate body; modernizing WTO rules to encompass areas such as digital services, subsidies, and technology transfer; and advancing negotiations in new areas such as digital trade. Other key areas that call for enhanced international cooperation include mitigating and adapting to climate change, addressing cross-border tax evasion and corruption, and avoiding a rollback of financial regulatory reforms. Policymakers should ensure multilateral institutions remain adequately resourced to counteract disruptive portfolio adjustments in a world economy heavily laden with debt.

At the national level, key priorities shared across countries include enhancing inclusion, strengthening resilience to turbulent turns in international financial markets, and addressing constraints that inhibit potential output growth (which for some means implementing product and labor market reforms to boost productivity and for others raising labor force participation rates). More specifically, across country groups,

- For advanced economies, where growth in final demand is generally subdued, inflation pressure is muted, and market-pricing-implied measures of inflation expectations have dipped in recent months, accommodative monetary policy remains appropriate. Monetary accommodation can, however, foster financial vulnerabilities, for which stronger macroprudential policies and a more proactive supervisory approach will be essential to curb financial market excesses. In some countries, bank balance sheets need further repair to mitigate the risk of sovereign-bank feedback loops. Fiscal policy should balance multiple objectives: smoothing demand as needed, protecting the vulnerable, bolstering growth potential with spending that supports structural reforms, and ensuring sustainable public finances over the medium term. If growth weakens more than envisaged in the baseline, depending on country circumstances, macroeconomic policies should turn more accommodative.

- Across emerging market and developing economies, the recent softening of inflation gives central banks the option of becoming accommodative, especially where output is below potential and inflation expectations are anchored. Debt has increased rapidly across many economies. Fiscal policy should therefore focus on containing debt while prioritizing needed infrastructure and social spending over recurrent expenditure and poorly targeted subsidies. This is particularly important in low-income developing economies to help them advance toward the United Nations Sustainable Development Goals. Macroprudential policies should ensure adequate capital and liquidity buffers to guard against disruptive shifts in global portfolios. Efforts to minimize balance sheet currency and maturity mismatches remain vital at a time when financial sentiment can rapidly switch to risk-off mode and will also ensure that these vulnerabilities do not hinder the essential buffering role of flexible exchange rates.

|

Table 1. Overview of the World Economic Outlook Projections |

|||||||||||

|

(Percent change, unless noted otherwise) |

|||||||||||

|

Year over Year |

|||||||||||

|

Difference from April 2019 WEO Projections 1/ |

Q4 |

over Q4 2/ |

|||||||||

|

Estimate |

Projections |

Estimate |

Projections |

||||||||

|

2017 |

2018 |

2019 |

2020 |

2019 |

2020 |

2018 |

2019 |

2020 |

|||

|

World Output |

3.8 |

3.6 |

3.2 |

3.5 |

–0.1 |

–0.1 |

3.3 |

3.4 |

3.5 |

||

|

Advanced Economies |

2.4 |

2.2 |

1.9 |

1.7 |

0.1 |

0.0 |

2.0 |

1.8 |

1.8 |

||

|

United States |

2.2 |

2.9 |

2.6 |

1.9 |

0.3 |

0.0 |

3.0 |

2.3 |

1.9 |

||

|

Euro Area |

2.4 |

1.9 |

1.3 |

1.6 |

0.0 |

0.1 |

1.2 |

1.6 |

1.5 |

||

|

Germany 3/ |

2.2 |

1.4 |

0.7 |

1.7 |

–0.1 |

0.3 |

0.6 |

1.2 |

1.2 |

||

|

France |

2.3 |

1.7 |

1.3 |

1.4 |

0.0 |

0.0 |

1.2 |

1.3 |

1.4 |

||

|

Italy |

1.7 |

0.9 |

0.1 |

0.8 |

0.0 |

–0.1 |

0.0 |

0.5 |

0.9 |

||

|

Spain |

3.0 |

2.6 |

2.3 |

1.9 |

0.2 |

0.0 |

2.3 |

2.1 |

1.9 |

||

|

Japan |

1.9 |

0.8 |

0.9 |

0.4 |

–0.1 |

–0.1 |

0.3 |

0.2 |

1.4 |

||

|

United Kingdom |

1.8 |

1.4 |

1.3 |

1.4 |

0.1 |

0.0 |

1.4 |

1.2 |

1.6 |

||

|

Canada |

3.0 |

1.9 |

1.5 |

1.9 |

0.0 |

0.0 |

1.6 |

1.8 |

1.7 |

||

|

Other Advanced Economies 4/ |

2.9 |

2.6 |

2.1 |

2.4 |

–0.1 |

–0.1 |

2.3 |

2.4 |

2.4 |

||

|

Emerging Market and Developing Economies |

4.8 |

4.5 |

4.1 |

4.7 |

–0.3 |

–0.1 |

4.5 |

4.8 |

4.9 |

||

|

Commonwealth of Independent States |

2.2 |

2.7 |

1.9 |

2.4 |

–0.3 |

0.1 |

3.1 |

2.2 |

1.4 |

||

|

Russia |

1.6 |

2.3 |

1.2 |

1.9 |

–0.4 |

0.2 |

2.9 |

2.0 |

1.0 |

||

|

Excluding Russia |

3.5 |

3.9 |

3.5 |

3.7 |

0.0 |

0.0 |

. . . |

. . . |

. . . |

||

|

Emerging and Developing Asia |

6.6 |

6.4 |

6.2 |

6.2 |

–0.1 |

–0.1 |

6.0 |

6.3 |

6.1 |

||

|

China |

6.8 |

6.6 |

6.2 |

6.0 |

–0.1 |

–0.1 |

6.4 |

6.1 |

5.9 |

||

|

India 5/ |

7.2 |

6.8 |

7.0 |

7.2 |

–0.3 |

–0.3 |

5.8 |

7.7 |

7.1 |

||

|

ASEAN-5 6/ |

5.3 |

5.2 |

5.0 |

5.1 |

–0.1 |

–0.1 |

5.2 |

5.0 |

5.3 |

||

|

Emerging and Developing Europe |

6.1 |

3.6 |

1.0 |

2.3 |

0.2 |

–0.5 |

0.7 |

1.4 |

3.3 |

||

|

Latin America and the Caribbean |

1.2 |

1.0 |

0.6 |

2.3 |

–0.8 |

–0.1 |

0.3 |

1.0 |

2.1 |

||

|

Brazil |

1.1 |

1.1 |

0.8 |

2.4 |

–1.3 |

–0.1 |

1.1 |

1.3 |

2.5 |

||

|

Mexico |

2.1 |

2.0 |

0.9 |

1.9 |

–0.7 |

0.0 |

1.6 |

1.3 |

1.6 |

||

|

Middle East, North Africa, Afghanistan, and Pakistan |

2.1 |

1.6 |

1.0 |

3.0 |

–0.5 |

–0.2 |

. . . |

. . . |

. . . |

||

|

Saudi Arabia |

–0.7 |

2.2 |

1.9 |

3.0 |

0.1 |

0.9 |

3.6 |

2.4 |

2.8 |

||

|

Sub-Saharan Africa |

2.9 |

3.1 |

3.4 |

3.6 |

–0.1 |

–0.1 |

. . . |

. . . |

. . . |

||

|

Nigeria |

0.8 |

1.9 |

2.3 |

2.6 |

0.2 |

0.1 |

. . . |

. . . |

. . . |

||

|

South Africa |

1.4 |

0.8 |

0.7 |

1.1 |

–0.5 |

–0.4 |

0.2 |

1.0 |

0.3 |

||

|

Memorandum |

|||||||||||

|

Low-Income Developing Countries |

4.7 |

4.9 |

4.9 |

5.1 |

–0.1 |

0.0 |

. . . |

. . . |

. . . |

||

|

World Growth Based on Market Exchange Rates |

3.2 |

3.0 |

2.7 |

2.9 |

0.0 |

0.0 |

2.8 |

2.7 |

2.8 |

||

|

World Trade Volume (goods and services) 7/ |

5.5 |

3.7 |

2.5 |

3.7 |

–0.9 |

–0.2 |

. . . |

. . . |

. . . |

||

|

Advanced Economies |

4.4 |

3.1 |

2.2 |

3.1 |

–0.6 |

0.0 |

. . . |

. . . |

. . . |

||

|

Emerging Market and Developing Economies |

7.4 |

4.7 |

2.9 |

4.8 |

–1.4 |

–0.3 |

. . . |

. . . |

. . . |

||

|

Commodity Prices (US dollars) |

|||||||||||

|

Oil 8/ |

23.3 |

29.4 |

–4.1 |

–2.5 |

9.3 |

–2.3 |

9.5 |

4.3 |

–7.0 |

||

|

Nonfuel (average based on world commodity import weights) |

6.4 |

1.6 |

–0.6 |

0.5 |

–0.4 |

–0.6 |

–1.8 |

2.5 |

0.6 |

||

|

Consumer Prices |

|||||||||||

|

Advanced Economies |

1.7 |

2.0 |

1.6 |

2.0 |

0.0 |

–0.1 |

1.9 |

1.9 |

1.8 |

||

|

Emerging Market and Developing Economies 9/ |

4.3 |

4.8 |

4.8 |

4.7 |

–0.1 |

0.0 |

4.2 |

4.1 |

4.0 |

||

|

London Interbank Offered Rate (percent) |

|||||||||||

|

On US Dollar Deposits (six month) |

1.5 |

2.5 |

2.4 |

2.3 |

–0.8 |

–1.5 |

. . . |

. . . |

. . . |

||

|

On Euro Deposits (three month) |

–0.3 |

–0.3 |

–0.3 |

–0.3 |

0.0 |

–0.1 |

. . . |

. . . |

. . . |

||

|

On Japanese Yen Deposits (six month) |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

0.0 |

. . . |

. . . |

. . . |

||

Note: Real effective exchange rates are assumed to remain constant at the levels prevailing during April 26–May 24, 2019. Economies are listed on the basis of economic size. The aggregated quarterly data are seasonally adjusted. WEO = World Economic Outlook.

1/ Difference based on rounded figures for the current and April 2019 World Economic Outlook forecasts. Countries whose forecasts have been updated relative to April 2019 World Economic Outlook forecasts account for 90 percent of world GDP measured at purchasing-power-parity weights.

2/ For world output, the quarterly estimates and projections account for approximately 90 percent of annual world GDP measured at purchasing-power-parity weights. For emerging market and developing economies, the quarterly estimates and projections account for approximately 80 percent of annual emerging market and developing economies' GDP measured at purchasing-power-parity weights.

3/ For Germany, the upward revision to the 2020 growth rate is due to the change in the GDP definition from a seasonally and working-day-adjusted (SWDA) basis in the April 2019 WEO to a nonadjusted basis. The 2020 growth projection on a SWDA basis has been revised down by 0.1 percentage point relative to the April 2019 WEO.

4/ Excludes the Group of Seven (Canada, France, Germany, Italy, Japan, United Kingdom, United States) and euro area countries.

5/ For India, data and forecasts are presented on a fiscal year basis and GDP from 2011 onward is based on GDP at market prices with FY2011/12 as a base year.

6/ Indonesia, Malaysia, Philippines, Thailand, Vietnam.

7/ Simple average of growth rates for export and import volumes (goods and services).

8/ Simple average of prices of UK Brent, Dubai Fateh, and West Texas Intermediate crude oil. The average price of oil in US dollars a barrel was $68.33 in 2018; the assumed price, based on futures markets (as of May 28, 2019), is $65.52 in 2019 and $63.88 in 2020.

9/ Excludes Venezuela.

Box 1. Trade Tensions, Monetary Policy, and Global Financial Conditions

Global financial markets have been wrestling with two key issues over the past three months.1 First, investors have become increasingly concerned about the impact of the intensification of trade tensions and the weakening economic outlook. Second, market participants have been grappling with the implications of these tensions for the monetary policy outlook.

The escalation in trade tensions in early May brought to a halt the rally seen in financial markets since the beginning of the year. Equity markets sold off, and corporate credit spreads widened. Emerging market sovereign bond spreads also rose, and portfolio flows to these economies retrenched.

Since mid-June, a number of central banks have signaled a dovish shift in their monetary policy stance, citing muted inflation and increased downside risks to growth. The US Federal Reserve shifted down the expected path of its policy rate, while the European Central Bank extended its forward guidance to keep its interest rates at current levels until at least mid-2020. Other central banks have also turned dovish or communicated a more cautious view on the outlook (including in Australia, Brazil, Chile, China, India, Malaysia, and the Philippines).

This has led to further market reassessment of the expected path of monetary policy. Investors now anticipate more significant policy easing from central banks, including in the United States. This supportive environment has helped markets regain their poise. Global share prices have recovered much of the ground lost in May, and market interest rates have continued to decline across a wide swath of economies.

1 This box was prepared by the IMF Monetary and Capital Markets Department.

As of mid-July, 10-year government bond yields have dropped by about 45 basis points since March in the United States, to 2.10 percent, by about 30 basis points in Germany to –0.25 percent, and by about 10 basis points in Japan, to -0.12 percent.

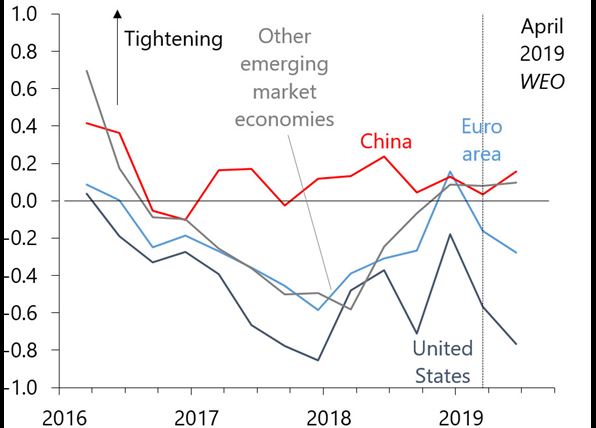

The overall impact of these developments has been further easing of global financial conditions since the April 2019 World Economic Outlook (Figure 1).

Figure 1. Global Financial Conditions Indices

(Number of standard deviations from mean)

Sources: Bank for International Settlements; Bloomberg Finance L.P.; Haver Analytics; IMF, International Financial Statistics database; and IMF staff calculations.

Note: Other emerging market economies comprise Brazil, India, Mexico, Poland, Russia, and Turkey. WEO = World Economic Outlook.

This easing has been particularly pronounced in the United States and the euro area, while financial conditions are little changed on net in China and in other major emerging market economies, in aggregate.