Safeguarding Macroeconomic Stability amid Continued Uncertainty in the Middle East and Central Asia

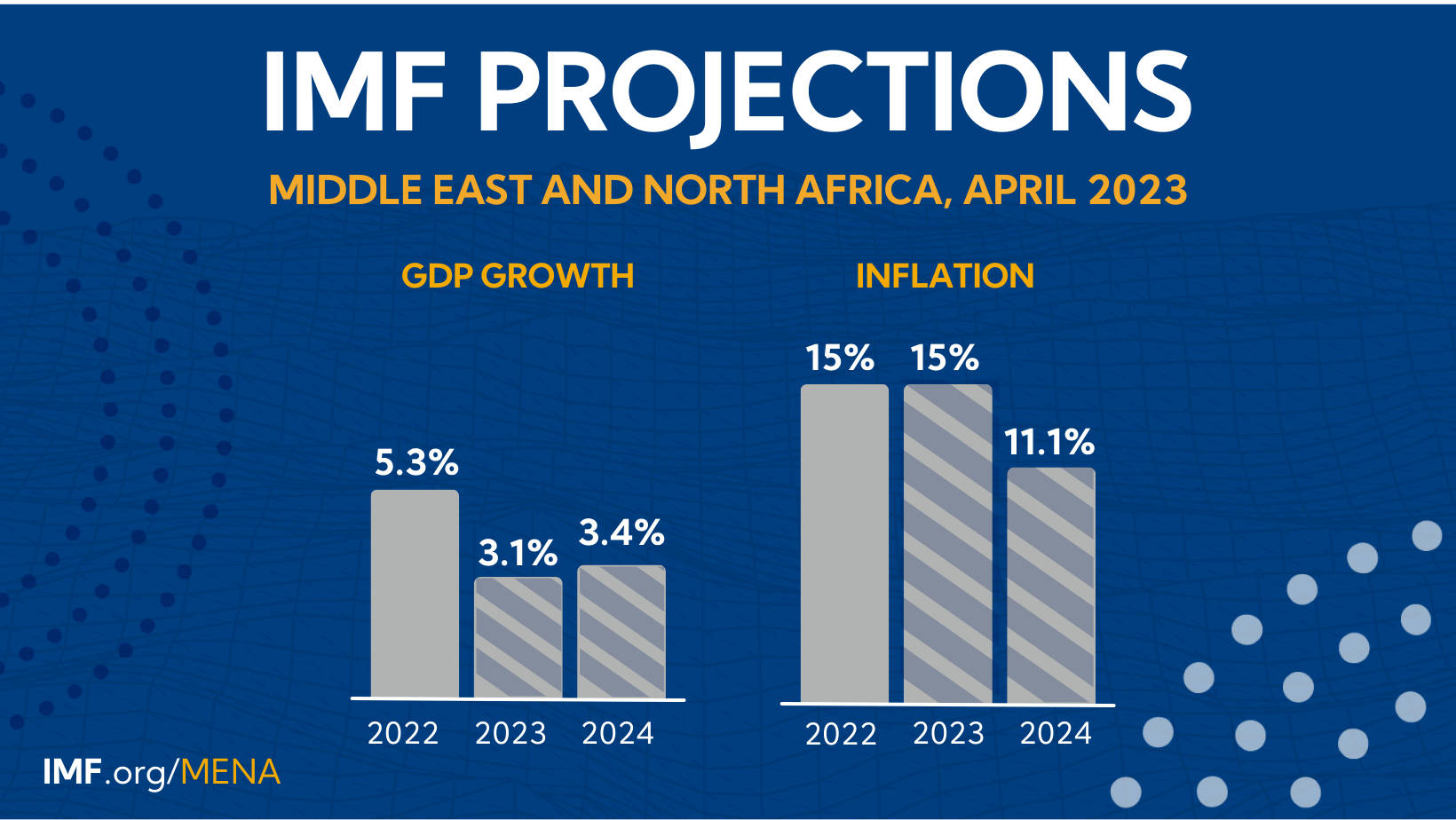

The economies of the Middle East and Central Asia (ME&CA) proved resilient in 2022, despite a series of global shocks. However, this year—and potentially next—growth is expected to slow in the Middle East and North Africa (MENA) as tight policies to fight inflation, reduce vulnerabilities, and rebuild buffers start to dent economic activity in many countries, and agreed oil production cuts curb growth in oil exporters. Inflation is projected to remain persistent. The outlook for Caucasus and Central Asia (CCA) countries depends heavily on external factors, namely the impact of monetary tightening, growth in their main trading partners, the pace of private transfers, and inflows of migrants from Russia. Uncertainty is high, and risks to the baseline are tilted to the downside amid financial stability concerns—particularly in advanced economies amid contagion fears. Policy trade-offs are even more complex, and policymakers will need to calibrate the policy mix carefully to reduce core inflation without triggering financial stress and excessive tightening and continue to provide targeted fiscal support to vulnerable groups while preserving debt sustainability and financial stability. Tight monetary and fiscal policies across the region amid tight global financial conditions call for accelerating structural reforms to bolster potential growth and enhance resilience.

Monetary Policy: Where Do the Middle East and Central Asia Stand?

The monetary policy response of Middle East and Central Asian (ME&CA) countries to the 2021–22 surge in inflation has varied widely. The current stance is appropriately tight or neutral for many countries using a policy rate, but it needs further tightening in others. The response to the latest inflation shock has been in line with or, in some cases, even more forceful than during previous inflation episodes. Nevertheless, in several countries monetary policy implementation continues to be undermined by a lack of coordination with fiscal policy or fiscal dominance. Monetary policy transmission in countries with floating or managed exchange rate regimes is stronger than in those with a peg, it operates mainly through the exchange rate channel, and the credit channel is relatively weak. Even countries that have responded appropriately would benefit from strengthening monetary policy frameworks and fostering financial development. Activating additional transmission channels would enhance central bankers’ ability to fight inflation while reducing their economic costs. In addition, greater exchange rate flexibility and the use of macroprudential policies could help strengthen monetary policy effectiveness. In countries where state-owned banks play an important role in financial intermediation, policymakers should also reduce their quasi-monetary and quasi-fiscal activities to improve transmission.

Publications

-

June 2024

Finance & Development

- An IMF for Tomorrow

-

September 2023

Annual Report

- Committed to Collaboration

-

Regional Economic Outlooks

- Latest Issues